Why we backed Vesto

The scoop on Vesto's Seed, led by Contrary with help from our friends at Susa Ventures and SV Angel

Imagine you just raised a $10 million seed round for your startup. Congratulations! This means more hiring, more building, more expansion, and enough runway to ride to new milestones and your next cash infusion. In the next 12-18 months, you won’t run out of money.

But a long runway means a massive pile of cash. While you draw from it to fund engineers and product development, the pile will be staring you in the face, shrinking slowly, and doing the most offensive thing stacks of money can do: nothing.

Money should be put to work. It can be invested, fund initiatives or at least collect interest. Lazy money not doing these wastes away. Inflation is at decades-long highs, and a pile of cash sitting around loses almost 10% of its purchasing power year over year.

There are ways to combat this. Individuals put their savings in markets, sometimes seeking excess returns by taking on risk. Their time-horizons can be long, so it’s no problem if they hit a downturn or those assets are illiquid. There’s plenty of time to earn back losses, and there’s no urgency in converting to cash.

Startups do not have these luxuries. For one, they need liquidity. A startup’s cash will be used to pay for business expenses, so locking them up for years is not a good idea. Second, they need stability. There might be unforeseen business expenses which requires drawing on cash reserves. An ill-timed market downturn can catastrophically reduce your runway.

What’s out there now

Large companies solve cash management by building their own treasury departments. They have a full-time staff dedicated to finding responsible yield for their cash and making sure they have enough for future expenditures. They’ll cook up strategies like bond ladders, where you have bonds with staggered maturity dates so money will be available when you need it, or an exotic mix of treasury bills, certificates of deposit, and even some equities to max out stable returns.

Apple, for example, has its own asset management company called Braeburn Capital to handle its cash. It has more than $200 billion AUM and is led by talent from KKR and Wells Fargo. Startups also have a treasury department, but it consists of the CEO and a Google Sheet.

Banks come in with partial solutions. They’ll give startups a money-market savings account where you get 1% in exchange for a service fee. This isn’t great. Your money is stuck in an old bank with confusing dashboards and variable customer service. Banks will even advertise yields as high as 3% for accounts under a certain amount, and then pull back to 1% once you get too large. Some also offer a managed treasury account that promises better support and higher yields, but these require sky-high minimums.

Vesto

Vesto is the easiest way to manage your corporate funds. Without changing banks, you can earn up to 4.5% on your cash with no account minimums or lock-ins. Their integrations make it simple to connect your existing accounts to Vesto’s infrastructure. In one dashboard, you get visibility into all your positions across cash, money market funds, and fixed income, so you can protect your runway while earning yield

.

Vesto will even work with you one-on-one to create the best plan for your runway, depending on expenditures, return preferences, and time to next cash infusion. It’s like having a 5-person treasury team at your disposal.

The opportunity

Corporate treasury alone is a market worth billions of dollars. Thousands of companies — not just startups — need seamless cash management solutions banks and other institutions don’t currently provide. But even the startup market is alone staggering. The raw number of startups created has exploded over the past couple of decades, and the side of each round has increased as well. This has led to ballooning cash balances.

Nobody doubts the benefit of shrewd treasury management (it’s basically free money!), but hassles and account minimums prevent companies from ever taking advantage of offerings. In rare cases, founders don’t even know there’s something more productive they can do with their runway. I’ve heard founders daydream about putting their cash to work but are afraid of the downside risk and effort. For them, Vesto is the natural solution for corporate treasury.

With this wedge, Vesto can grow into a number of valuable adjacent markets. Just consider FP&A as one example. Using the real-time view of a company’s liquid assets and runway already in Vesto, it would be convenient to develop hiring plans, create budgets, and run financial models on sales growth. Tracking expenditures and MRR could give increased visibility into operations and store information helpful for investors or the future Finance team. It all comes back to cash and its flow.

The competition

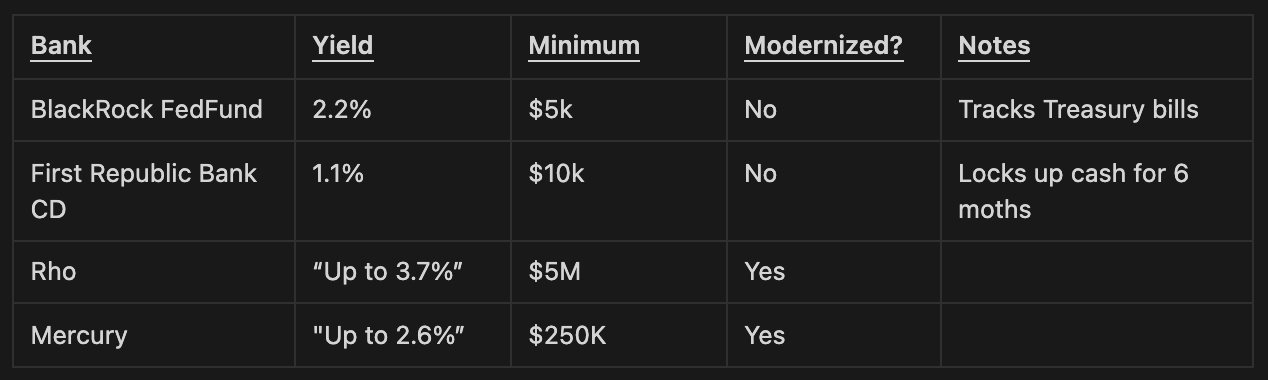

Winning the treasury market is step one. However, Vesto isn’t the first working on this problem. The following table reviews a few places cash can be kept:

The traditional banks have decent solutions well-integrated into your existing bank flows, but come with the constraints of a traditional bank. You may be sold a CD or liquidity fund, but rates are uninspiring (despite such high federal rates at the moment) and the options aren’t particularly customizable. Using their services also requires using them as a primary bank, unless you’re comfortable having a savings and checking account at different institutions.

New solutions face the same problems. Rho and Mercury might offer good visibility and comparable yields, but using their treasury solutions alone is prohibitive. They’re building neobanks, so they want to own all your funds. As a result, they’ve put minimal effort making treasury a standalone product.

If Vesto was building a bank like SVB, FRB, Rho, or Mercury, we’d be concerned. There are a lot of people going after the neobank angle, and Vesto doesn’t have an immediate distribution advantage here. Instead, they have flexibility. Building a bank requires targeting all a startup’s funds. Vesto can build a standalone treasury solution because they don’t care about getting the checking account with the savings. It’s all about treasury.

The team

We’re most excited by the Vesto team.

From the moment we met CEO Ben Doepfner, we were impressed. It’s always hard to distill first impressions into words, but one phrase sticks out: clarity of mind. Every challenge ahead feels trivial talking to Ben. With a plan for everything, it just comes down to execution.

Ben actually built Vesto’s cash management solution for himself. After he built his first business as a teenager in Germany where interest rates were zero or even negative, Ben tried to find a place for his money. The goal was to use it for another business, so a potentially volatile mix of equities was out. He wanted a treasury solution but realized the space was lacking. He called banks, but they required multi-million dollar minimums and didn’t even give much yield. This planted the idea in his head.

Contrary has led the round, and we’re honored to do so with participation from our friends at Susa Ventures and SV Angel, and the founders of Tinder, SoFi, and DoNotPay. We’re quite excited to partner.

Why Vesto will win

Corporate finance is a brutally difficult space. Many have tried and failed. Corporate treasury represents a compelling beachhead — it’s tractable, but also gives line-of-sight to related products and services. Vesto is early, but we really believe in the team. The product (and product velocity) are great signs of what’s to come. With elegant execution, there’s so much room to run.

If you’re a venture-backed founder doing nothing with your cash, reply to this email. No promises, but I can ask Ben to give you priority access to the product.

You can also read more about Vesto in TechCrunch here.

Views expressed in any content, including posts, linked on this website or posted to social media and other platforms are my own and not the views of Contrary LLC or any affiliate. None of the content should be construed or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to these matters. Under no circumstances should any posts or content be construed as any offer to provide advisory services or a solicitation of any investment in any security or investment vehicle. Certain information has been obtained from third party sources and has not been independently verified. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Past performance is not necessarily indicative of future results. See contrary.com/legal for additional important information. Contrary, through one or more affiliates, is an investor in Vesto.

Nice write-up.

Interestingly, in DeFi, DAO treasuries were first convinced to gain yield on funds through composable integrations with money markets, undercollateralized lending protocols and delta-neutral strategies.

With the arrival of the bear market, yields have compressed and access to US treasuries, corporate debt and MMFs results in equivalent or better yields at significantly less risk - yet there are few solutions for this.

Being an SMB owner, I can confirm the pain of treasury management. While a corporate CFO may know about MMFs and can tranche treasuries to maximize returns on what otherwise would be in idle in a bank account, the average finance person at a 5-50 person SMB does not. For them, the abysmal returns of the bank and related fees are the only route. Otherwise you have to create a corporate account at a broker (e.g. Interactive Brokers) and purchase the products directly, and this isn't within everyone's skillset.

Strikes me that Vesto can have a great captive audience here. Just have to reach those people.