Domino's Pizza Beats Any Tech Stock

Businesses that appear to be commoditized can often times outperform even the strongest products and services.

As tech giants continue to dip in valuation (e.g. META 0.00%↑ down a staggering 69% over the past year, and GOOGL 0.00%↑ down 40% over that same period), I’ve been interested in undiscovered winners from the past several years.

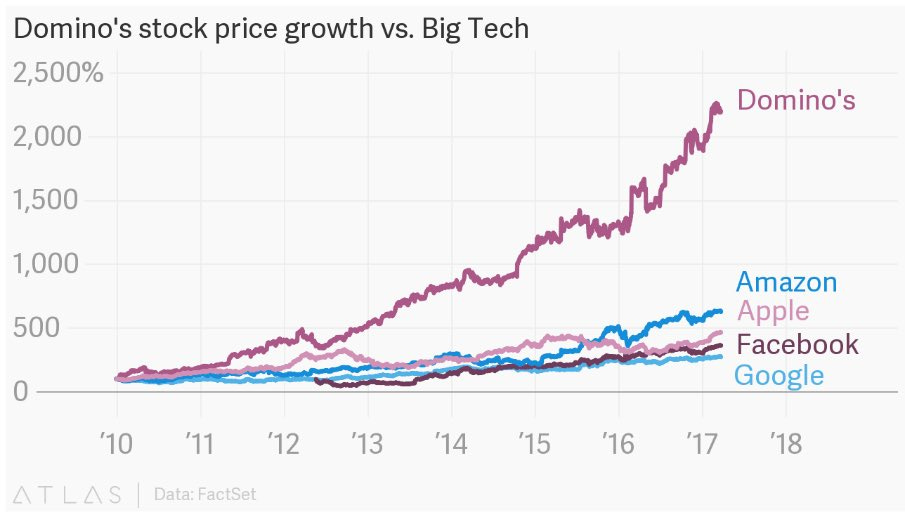

Domino’s Pizza (DPZ 0.00%↑) has famously crushed the returns of blue chip tech stocks over the past decade:

Of course it’s hard to compound at 2,000% when Amazon, Apple, Facebook, and Google were already worth far more than Dominos to begin with. But the point remains: Dominos invested heavily in world-class logistics & IT infrastructure, drove online and mobile app sales before it was cool, and quietly scaled an empire.

Investors often wish they had bought Bitcoin back in 2010. Arguably Domino’s stock is a better asset to hold given the real assets on its balance sheet and softer volatility. What a run they’ve had.

Today, a number of businesses have leaned into similar web/mobile ordering efforts to bump sales and logistical efforts to streamline costs and standardize the customer experience at massive scale.

Chipotle (CMG 0.00%↑) is up 10x since 2010, and is now worth $38 billion.

Starbucks (SBUX 0.00%↑) is up 9x since 2010, and is now worth a staggering $105 billion!

This is worth more than all but the most epic Silicon Valley companies ever built. It’s remarkable.

Although mobile apps and loyalty programs certainly drive revenue, companies need to standardize and optimize to scale efficiently and save costs at the same time.

This inevitably leads to a worse customer experience, and eventually brand, and eventually revenue.

The Oxford University Press published a memo sent by Starbucks CEO Howard Schultz to the executive team prior to a board meeting. He tackles the problem of commoditization at scale head-on:

From: Howard Schultz

Sent: Wednesday, February 14, 2007 10:39 AM Pacific Standard Time

To: Jim Donald

Cc: Anne Saunders; Dave Pace; Dorothy Kim; Gerry Lopez; Jim Alling; Ken Lombard; Martin Coles; Michael Casey; Michelle Gass; Paula Boggs; Sandra TaylorSubject: The Commoditization of the Starbucks Experience

As you prepare for the FY 08 strategic planning process, I want to share some of my thoughts with you.

Over the past ten years, in order to achieve the growth, development, and scale necessary to go from less than 1,000 stores to 13,000 stores and beyond, we have had to make a series of decisions that, in retrospect, have lead to the watering down of the Starbucks experience, and, what some might call the commoditization of our brand.

Many of these decisions were probably right at the time, and on their own merit would not have created the dilution of the experience; but in this case, the sum is much greater and, unfortunately, much more damaging than the individual pieces. For example, when we went to automatic espresso machines, we solved a major problem in terms of speed of service and efficiency. At the same time, we overlooked the fact that we would remove much of the romance and theatre that was in play with the use of the La Marzocca machines. This specific decision became even more damaging when the height of the machines, which are now in thousands of stores, blocked the visual sight line the customer previously had to watch the drink being made, and for the intimate experience with the barista. This, coupled with the need for fresh roasted coffee in every North America city and every international market, moved us toward the decision and the need for flavor locked packaging. Again, the right decision at the right time, and once again I believe we overlooked the cause and the affect of flavor lock in our stores. We achieved fresh roasted bagged coffee, but at what cost? The loss of aroma -- perhaps the most powerful non-verbal signal we had in our stores; the loss of our people scooping fresh coffee from the bins and grinding it fresh in front of the customer, and once again stripping the store of tradition and our heritage? Then we moved to store design. Clearly we have had to streamline store design to gain efficiencies of scale and to make sure we had the ROI on sales to investment ratios that would satisfy the financial side of our business. However, one of the results has been stores that no longer have the soul of the past and reflect a chain of stores vs. the warm feeling of a neighborhood store. Some people even call our stores sterile, cookie cutter, no longer reflecting the passion our partners feel about our coffee. In fact, I am not sure people today even know we are roasting coffee. You certainly can't get the message from being in our stores. The merchandise, more art than science, is far removed from being the merchant that I believe we can be

and certainly at a minimum should support the foundation of our coffee heritage. Some stores don't have coffee grinders, French presses from Bodum, or even coffee filters.

Now that I have provided you with a list of some of the underlying issues that I believe we need to solve, let me say at the outset that we have all been part of these decisions. I take full responsibility myself, but we desperately need to look into the mirror and realize it's time to get back to the core and make the changes necessary to evoke the heritage, the tradition, and the passion that we all have for the true Starbucks experience. While the current state of affairs for the most part is self induced, that has lead to competitors of all kinds, small and large coffee companies, fast food operators, and mom and pops, to position themselves in a way that creates awareness, trial and loyalty of people who previously have been Starbucks customers. This must be eradicated.

I have said for 20 years that our success is not an entitlement and now it's proving to be a reality. Let's be smarter about how we are spending our time, money and resources. Let's get back to the core. Push for innovation and do the things necessary to once again differentiate Starbucks from all others. We source and buy the highest quality coffee. We have built the most trusted brand in coffee in the world, and we have an enormous responsibility to both the people who have come before us and the 150,000 partners and their families who are relying on our stewardship.

Finally, I would like to acknowledge all that you do for Starbucks. Without your passion and commitment, we would not be where we are today.

Stated out loud, many of these problems seem rather trivial. The aroma in a store sounds like a made up problem in the context of the massive hiring, logistics, financial planning, and marketing challenge that Starbucks deals with operationally.

Ultimately the results speak for themselves. Since this was written on Valentine’s Day 2007, Starbucks is 5x as valuable, even after losing a few years of growth to the Great Recession.

But my question to the reader is not as direct: how much of this was attributable to basic business expansion — store count growth, economies of scale of inputs, etc — and how much was due to the team’s tender care for the “experience” and avoiding the commoditization of a scaled product?

It’s a unique problem to have. Most software businesses become clearly better at scale from a user perspective, but consumer brands have the opposite problem in some ways.

As every brand like Domino’s tries desperately to become more a tech company, it does make one wonder how traditional “Silicon Valley” tech companies can learn from Howard Schultz’s fear of a commoditized experience.

Views expressed in any content, including posts, linked on this website or posted to social media and other platforms are my own and not the views of Contrary LLC or any affiliate. None of the content should be construed or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to these matters. Under no circumstances should any posts or content be construed as any offer to provide advisory services or a solicitation of any investment in any security or investment vehicle. Certain information has been obtained from third party sources and has not been independently verified. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Past performance is not necessarily indicative of future results. See contrary.com/legal for additional important information.